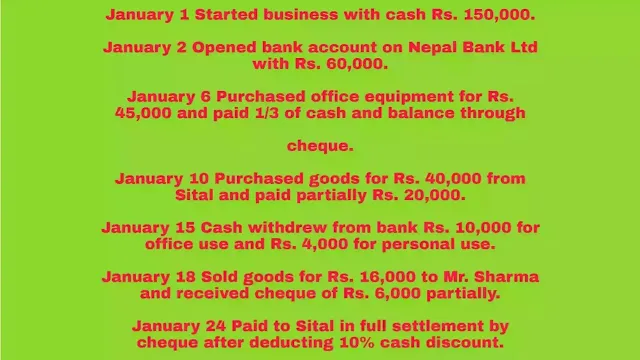

January 1 Started business with cash Rs. 150,000.

January 2 Opened bank account on Nepal Bank Ltd with Rs. 60,000.

January 6 Purchased office equipment for Rs. 45,000 and paid 1/3 of cash and balance through cheque.

January 10 Purchased goods for Rs. 40,000 from Sital and paid partially Rs. 20,000.

January 15 Cash withdrew from bank Rs. 10,000 for office use and Rs. 4,000 for personal use.

January 18 Sold goods for Rs. 16,000 to Mr. Sharma and received cheque of Rs. 6,000 partially.

January 24 Paid to Sital in full settlement by cheque after deducting 10% cash discount.

January 26 Paid sundry expenses for Rs. 2,000 by cheque.

January 30 Paid Rs. 12,000 for wages and salaries.

January 31 Issued cheque of Rs. 18,000 to Sital after deducting 10% discount

Required: Double column cash book with cash and bank column.

Ans: Balance: Cash Rs. 53,000 (Dr.); Bank Rs. 16,000 (Cr.)

| Date | Particulars | PR | Cash | Bank | Date | Particulars | PR | Cash | Bank |

| January 1 January 2 January 15 January 24 January 31 Feb. 1 | To capital a/c To cash a/c To Bank a/c To sales a/c To Balance c/d To Balance b/d | C C | 150,000 10,000 160000 53,000 | 60,000 6,000 16,000 82000 | January 2 January 6 January 10 January 15 January 15 January 24 January 26 January 30 January 31 January 31 Feb. 1 | By Bank a/c By office equipment a/c By purchase a/c By cash a/c By Drawing a/c By Sital' a/c By sundry expenses a/c By wages and salaries a/c By Sital's a/c By Balance c/d By Balance b/d | C C | 60,000 15,000 20,000 12,000 53000 160000 | 30,000 10,000 4,000 18,000 2,000 18,000 82000 16000 |