Record each transaction shown below directly in continuous balance ledger. Each account involved needs a separate at account:

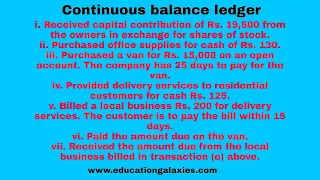

i. Received capital contribution of Rs. 19,500 from the owners in exchange for shares of stock.

ii. Purchased office supplies for cash of Rs. 130.

iii. Purchased a van for Rs. 15,000 on an open account. The company has 25 days to pay for the van.

iv. Provided delivery services to residential customers for cash Rs. 125.

v. Billed a local business Rs. 200 for delivery services. The customer is to pay the bill within 15 days.

vi. Paid the amount due on the van.

vii. Received the amount due from the local business billed in transaction (e) above.

Solution: Journal Entries

| Date | Account Titles and Explanation | PR | Debit (Rs.) | Credit (Rs.)/ |

| i. | Cash a/c Dr. To Capital a/c (For capital contribution received from the owners) | 19500 | 19500 | |

| ii. | Office supplies a/c Dr. To cash a/c (For purchase of office supplies) | 130 | 130 | |

| iii. | Van a/c Dr. To Accounts payable a/c (For purchase of van on open account) | 15000 | 15000 | |

| iv. | Cash a/c. Dr. To service revenue a/c (For delivery services provided to residential customers for cash) | 125 | 125 | |

| v. | Accounts receivable a/c. Dr. To service revenue a/c (For delivery services provided for cash) | 200 | 200 | |

| vi. | Accounts payable a/c. Dr. To cash a/c (For paid the amount due on the van) | 15000 | 15000 | |

| vii. | Cash a/c. Dr. To Accounts receivable a/c (For the amount due received from local business billed in transaction (e) ) | 200 | 200 |

Ledger Accounts: Continuous form ledgers

Cash Account

| Date | Particulars | PR | Debit | Credit | Dr./Cr. | Balance |

| i. ii. iv. vi. vi | Capital a/c. Office supplies a/c. Service revenue a/c. Accounts Payable a/c. Accounts receivable a/c. | 19500 125 200 | 130 15000 | Dr. Dr. Dr. Dr. Dr. | 19500 19370 19495 4495 4695 |

| Date | Particulars | PR | Debit | Credit | Dr./Cr. | Balance |

| i. | Cash a/c | 19500 | Cr. | 19500 |

Office Supplies Account

| Date | Particulars | PR | Debit | Credit | Dr./Cr. | Balance |

| ii. | Cash a/c | 130 | Dr. | 130 |

Van Account

| Date | Particulars | PR | Debit | Credit | Dr./Cr. | Balance |

| iii. | Accounts payable a/c | 15000 | Dr. | 15000 |

Accounts Payable Account

| Date | Particulars | PR | Debit | Credit | Dr./Cr. | Balance |

| iii. vi. | Van a/c Cash a/c | 15000 | 15000 | Cr. Cr. | 15000 0 |

Service Revenue Account

| Date | Particulars | PR | Debit | Credit | Dr./Cr. | Balance |

| iv. v. | Cash a/c Accounts receivable a/c | 125 200 | Cr. Cr. | 125 325 |

Accounts Receivable Account

| Date | Particulars | PR | Debit | Credit | Dr./Cr. | Balance |

| v. vii. | Service revenue a/c Cash a/c | 200 | 200 | Dr. Dr. | 200 0 |