The following transactions occurred during the month of July of a business:

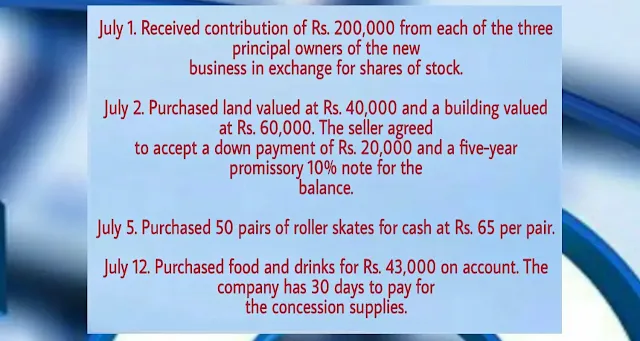

July 1. Received contribution of Rs. 200,000 from each of the three principal owners of the new business in exchange for shares of stock.

July 2. Purchased land valued at Rs. 40,000 and a building valued at Rs. 60,000. The seller agreed to accept a down payment of Rs. 20,000 and a five-year promissory 10% note for the balance.

July 5. Purchased 50 pairs of roller skates for cash at Rs. 65 per pair.

July 12. Purchased food and drinks for Rs. 43,000 on account. The company has 30 days to pay for the concession supplies.

July 13. Sold tickets for cash of Rs. 12,000 and took in Rs. 9,000 at the concession stand.

July 17. Rented out the roller rink to a local community group for Rs. 14,500. The community group is to pay half of the bills within 10 working days and has 30 days to pay the remainder.

July 23. Received 50% of the amount billed to the local community group.

July 24. Sold tickets for cash of Rs. 8,000, and took in Rs. 5,000 at the concession stand.

July 26. The three friends, acting on behalf of KTM Roller Rink, paid a dividend of Rs. 600 on the shares of stock owned each of them.

July 27. Paid Rs. 6,000 for utilities.

July 30 Paid wages and salaries of Rs. 25,000.

July 31. Sold tickets for cash of Rs. 4,000, and took in Rs. 5,500 at the concession stand.

Required:

Record each transaction directly in T-Accounts, using the dates preceding the transaction to identify them in accounts.

Each account involved in the problem need a separate T-account.

Ans: Cash account Rs. 594,700 (Dr.)

| Date | Particulars | PR | Debit (Rs.) | Credit (Rs.) |

| July 1 | Cash a/c Dr. To share capital a/c (For capital contribution from three owners @ Rs. 200,000 each) | 600,000 | 600,000 | |

| July 2 | Land a/c Dr. Building a/c Dr. To cash a/c To 5 years, 10% notes payable a/c (Being land and building purchased on cash and a five years promissory note) | 40,000 60,000 | 20,000 80,000 | |

| July 5 | Office equipment a/c Dr. To cash a/c (For purchase of roller skates on cash) | 3,250 | 3,250 | |

| July 12 | Office supplies a/c Dr. To Accounts payable a/c ( For purchase of food and drinks on account) | 43,000 | 43,000 | |

| July 13 | Cash a/c Dr. To sales revenue a/c To service revenue a/c (For tickets sold on cash) | 21,000 | 21,000 | |

| July 17 | Accounts Receivable a/c Dr. To service revenue a/c (For the roller rink rented out on credit) | 14,500 | 14,500 | |

| July 23 | Cash a/c Dr. To Accounts receivable a/c (For 50% of the billed amount received) | 7,250 | 7,250 | |

| July 24 | Cash a/c Dr. To sales revenue a/c To service revenue a/c (For tickets sold on cash) | 13,000 | 8,000 5,000 | |

| July 26 | Dividend a/c Dr. To cash a/c (For a dividend paid on the shares of stock) | 1,800 | 1,800 | |

| July 27 | Utilities expenses a/c Dr. To cash a/c (For utility paid) | 6,000 | 6,000 | |

| July 30 | Wages & salaries a/c Dr. To cash a/c (For wages and salaries paid) | 25,000 | 25,000 | |

| July 31 | Cash a/c Dr. To sales revenue a/c To service revenue a/c ( For tickets sold on cash) | 9,500 | 4,000 5,500 |

| (July 1) 600,000 | 20,000 (July 2) |

| (July 13) 21,000 | 3,250 (July 5) |

| (July 23) 7,250 | 1,800 (July 26) |

| (July 24) 13,000 | 6,000 (July 27) |

| (July 31) 9,500 | 25,000 (July 30) |

| (b/d) 594,700 |

| 600,000 ( July 1) | |

| 600,000 (b/d) |

| (July 2) 40,000 | |

| (b/d) 40,000 |

| (July 2) 60,000 | |

| (b/d) 60,000 |

| 80,000 ( July 2) | |

| 80,000 (b/d) |

| (July 5) 3,250 | |

| (b/d) 3,250 |

| (July 12) 43,000 | |

| (b/d) 43,000 |

| 43,000 (July 12) | |

| 43,000 (b/d) |

| 12,000 (July 13) | |

| 8,000 (July 24) | |

| 4,000 (July 31) | |

| 24,000 (b/d) |

| 9,000 (July 13) | |

| 14,500 (July 17) | |

| 5,000 (July 24) | |

| 5,500 (July 31) | |

| 34,000 (b/d) |

| (July 17) 14,500 | 7,250 (July 23) |

| (b/d) 7,250 |

| (July 26) 18,000 | |

| (b/d) 18,000 |

| (July 27) 6,000 | |

| (b/d) 6,000 |

| (July 30) 25,000 | |

| (b/d) 25,000 |